Global Forum For Indurstrial Devlopment is SPONSORED BY ICO INDIA

- MP Society Registration (Act. 1973 No. 44) 03/27/01/21857/19 (MSME Forum Established Since-2009)

Your business is as good as your team. Fast-paced startups are becoming a preferred workplace for individuals entering the job market. Many startups put wellness as a priority in their company culture; however, founders should pay attention to employee health insurance too.

Health insurance generally costs more for individuals to purchase, be it for themselves or their families. Company-provided health insurance is more desirable for employees and can be a significant motivating factor for them to stay with you.

Now that you know why you should prioritize your team’s health insurance, it’s time to see the steps you need to take to choose your startup’s right health insurance.

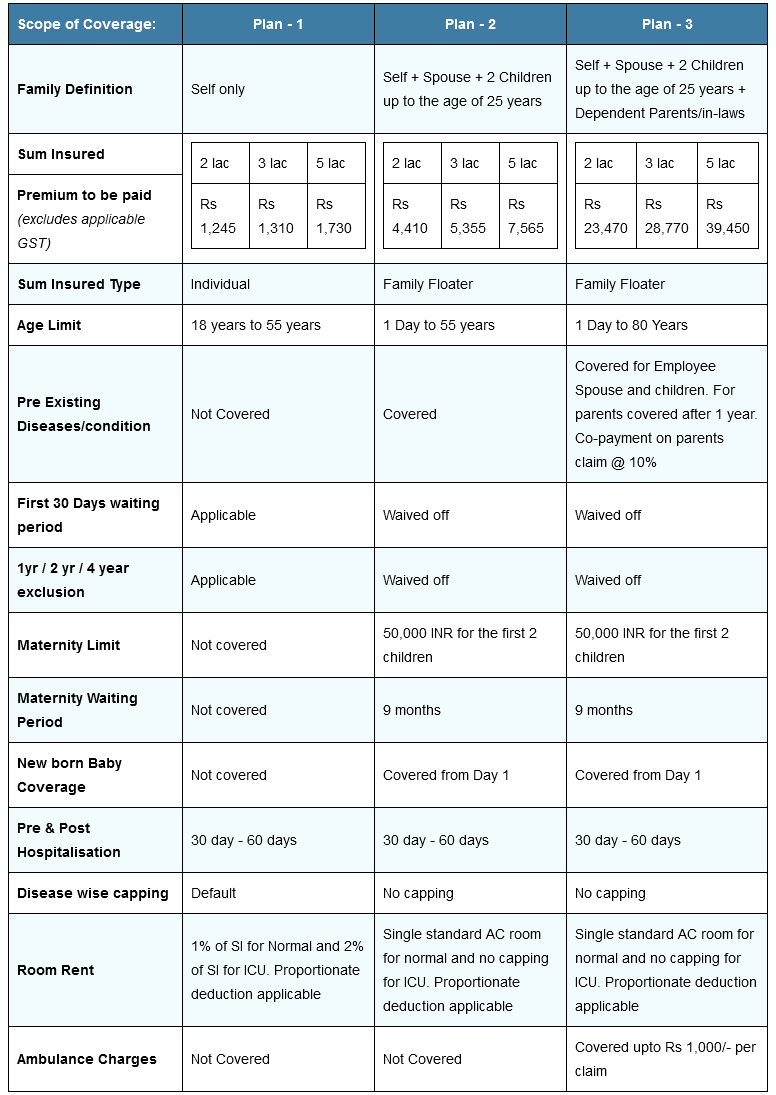

GFID INDIA, in partnership with PlanCover.com for the first time in India, brings to you a Group Health Insurance Cover titled “GFID INDIA Suraksha”. This health insurance is carefully designed, keeping in mind our members get maximum coverage and benefits at cost & terms available only to large employers.

Some of the salient features of this policy are –

This Group health policy is exclusively available only for Members of GFID INDIA (and their employees). Founders who are current members and have an organisation (registered & incorporated) with full time employees can enrol. Their employees don’t have to take additional membership to avail the benefit. The policy will be in force for the time period you are a renewed and a paid member.